Ira rmd calculator 2021

Ad Build Assets Be Tax-Smart. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

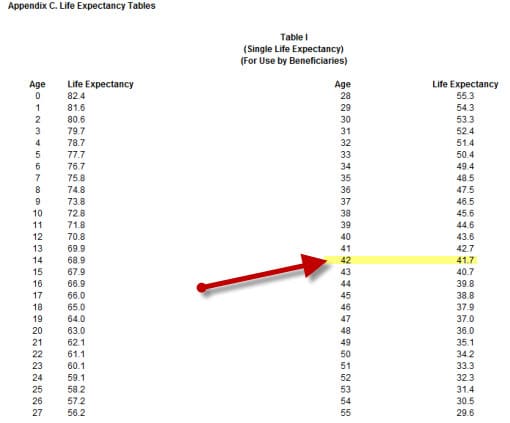

Determine beneficiarys age at year-end following year of owners.

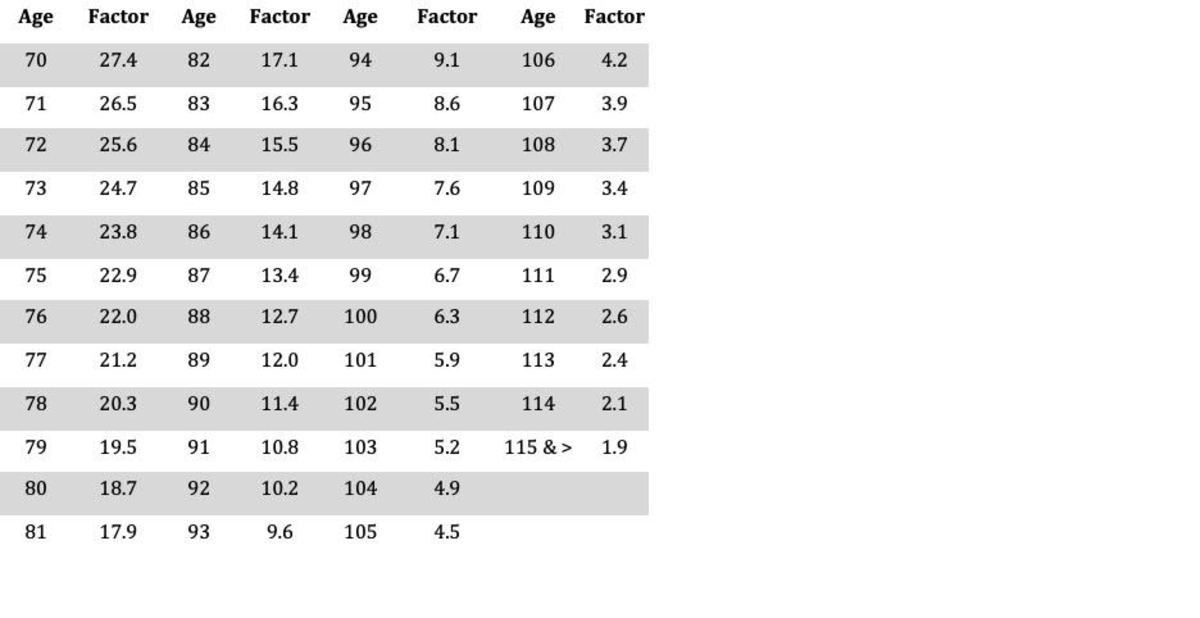

. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Reviews Trusted by Over 20000000. Under the old table the divisor was 229.

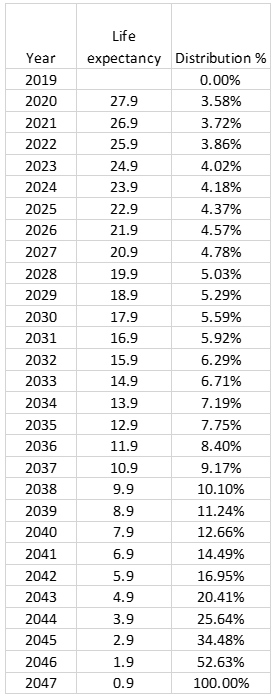

IRA Required Minimum Distribution RMD Table for 2022. Required Minimum Distribution Calculator Avoid stiff penalties for taking out too little from tax-deferred retirement plans. You are retired and your 70th birthday was July 1 2019.

Run the numbers to find out. Determine your Required Minimum Distribution RMD from a traditional 401k or IRA. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

If you want to simply take your. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. The second by December 31.

2022 Retirement RMD Calculator Important. Your life expectancy factor is taken from the IRS. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

It Is Easy To Get Started. The age for withdrawing from retirement accounts was. 401k Save the Max Calculator.

RMD amounts depend on various factors such as the decedents age at death the year of death the type of. Compare IRAs And Find One Tailored For Your Retirement Needs. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you.

Ira rmd calculator 2021 Selasa 20 September 2022 Edit. Schwab Has 247 Professional Guidance. Required Minimum Distribution Calculator.

Reviews Trusted by Over 20000000. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Account balance as of December 31 2021. 401k and IRA Required Minimum Distribution Calculator. Calculate your earnings and more.

Note that if you delay your first RMD until April youll have to take 2 RMDs your first year. Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA. 1 Use FINRAsRequired Minimum Distribution Calculator to calculate your current years RMD.

Ad Use This Calculator to Determine Your Required Minimum Distribution. In general your age and acc. For an IRA with a balance of 700000 on 12312021 the difference in RMD is 28455 new table versus 30568 old table.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Calculate your earnings and more. IRA Required Minimum Distribution RMD Table for 2022.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. The first will still have to be taken by April 1. Distribute using Table I.

These amounts are often called required minimum distributions RMDs. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required. Lets say you celebrated your 72nd birthday on July 4 2021.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Compare 2022s Best Gold IRAs from Top Providers. Our convenient RMD service allows you to authorize Merrill to automatically calculate and distribute your annual RMD from your IRAs to a Merrill or Bank of America account or to an.

How is my RMD calculated. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Its equal to 50 percent of the amount you were supposed to withdraw.

Use this calculator to determine your Required Minimum Distribution RMD from a traditional 401k or IRA. Calculate the required minimum distribution from an inherited IRA. Use this worksheet for 2021.

The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Compare 2022s Best Gold IRAs from Top Providers.

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Distributions Rules Heintzelman Accounting Services

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Where Are Those New Rmd Tables For 2022

Rmd Table Rules Requirements By Account Type

Required Minimum Distributions Update 2021 Fcmm Benefits Retirement

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Distribution Calculator Estimate Minimum Amount

The Inherited Ira Portfolio Seeking Alpha

Rmd Tables

Required Minimum Distribution Calculator

Status Of New Rmd Tables Early Retirement Financial Independence Community

Rmd Table Rules Requirements By Account Type

Rmd Tables

Ira Rmd Calculator Ira Owners 70 1 2 72 Secure Act And Older

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Calculating The Required Minimum Distribution From Inherited Iras Morningstar